In the last post I mentioned that my goal for this year is to earn $10,000 mining cryptocurrency. That post was getting a little long, so I wanted to do a follow up to try to explain it a little more in depth.

First, let me be clear: I still don’t understand cryptocurrencies completely, so be forewarned. Here’s what I do know: they’re real, and legitimate. You can invest in them much like you can any other publicly traded stock, except they’re often on different platforms.

Coinbase, like I mentioned in the last post, is an example of a digital wallet. Think of this like a cross between your stock brokerage and a savings account. It allows you to convert cryptocurrencies of one token to another, or to buy and sell them outright.

So for an average investor who has no interest in mining cryptocurrencies, you can still invest in them. If you think that the price of a certain token is going to rise, you can buy some on Coinbase, or another wallet, and sell it when the price goes up. Be forewarned, however, that investing in cryptocurrencies can be extremely volatile. The prices can and will skyrocket and plummet dramatically.

So, there’s definitely opportunity for profit, but equal chances of losses. I do have a bit invested in different cryptocurrencies, but I’m also choosing to take a more active role by mining my own tokens. This involves building a computer to perform mathematical computations to create the token.

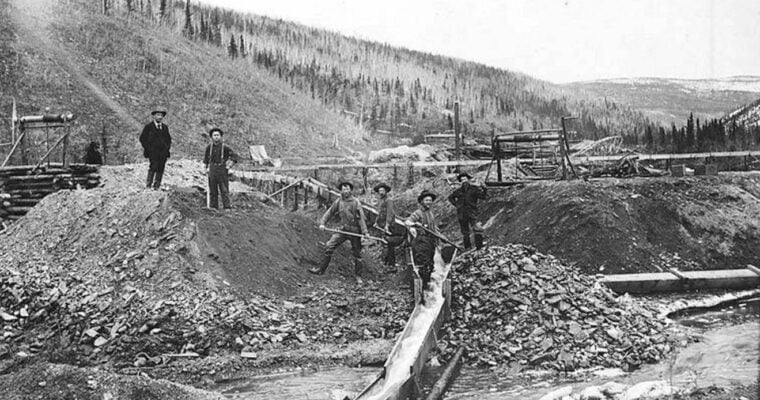

As a metaphor, think of a traditional gold miner. They would exchange physical effort for the chance to find gold. In cryptocurrency mining, we’re exchanging electricity for our computer to do the work in exchange for “finding” the token. At least, that’s how I understand it.

Much like we can buy and sell different tokens, we can also mine different tokens. The profitability of doing so depends on the type of token that we choose. For instance, it’s much more difficult to mine Bitcoin than it is to mine, say, Ethereum.

This is because each token has a certain degree of “difficulty,” or how hard it is to “find” the token.

Also, the stronger and faster our computer, the more profitable we can be. This is because it increases the speed and odds of us “finding” tokens. In my case, I will be building a computer using graphics cards.

The more graphics cards and the more efficient they are determines how much power your computer will consume and how efficient it will be in mining. It has a direct correlation to profitability.

In my case, I’m staring out with two RX 580 8gb graphics cards from MSI. These were $350 each, used, on eBay. The thing is, this is the absolute WORST time to be building a mining rig, but I still want to.

Because of the pandemic, there’s a supply shortage for the materials to make new graphics cards. Plus, there’s more people at home with more free time. People are opting to build their own computers and mining rigs. That’s because mining cryptocurrencies is profitable again.

So because of the shortage, the cards are sold out everywhere. It’s almost impossible to find them. And when you can find them, they’re often three times the price. That said, I still want to do it.

I’ve looked into this over the years and always decided against it because it never seemed profitable enough. But, because Bitcoin recently broke $40,000 ($46,000 today!), the prices of other tokens has sympathetically risen as well. This has made mining profitable once again.

So for my case, as of right now, my two 580 graphics cards will produce $3.51 each, or $7.02 worth of Ethereum (token) per day. This changes wildly depending on how much one Ethereum is worth. And, that’s after calculating the increased electricity cost of running this rig.

So, you might be thinking, is $7.02 a day really worth it? Well, for me – yes. $7.02 a day is $210.60 per month, or $2562.30 a year. Wait, isn’t that how much I made after 1,000 hours of working on eBay in 2020? Yes, yes it was. Except in this case, my mining rig is doing the work for me. I just have to set it up, monitor it, and collect.

And, I don’t plan on stopping there. I plan on reinvesting the profits into buying more cards with greater efficiency to increase my profitability. Again, this can drastically decrease if the price of Ethereum drops, but to me it’s worth the risk.

As an added bonus, after we’ve generated the tokens we can do what we like with them. We can hold on to them until the price skyrockets, or sell them to cover the cost of electricity and reinvest for more units.

Now, I do want to expand and I do think this has great potential to help my family, and me, so I don’t have to work so much. I just have to prove that I can get the first rig to work, first.

If you’ve built a mining rig before I’d love to hear your thoughts. Chances are, I’m going to need some help so if you have some advice please let me know in the comments below.